Sage 50 Payroll is simple and straightforward, easy to use, suitable for all business types, ideal for businesses with between 5-300 employees. Process each and every payroll with confidence, safe in the knowledge that the legislation is current and up to date. All information is processed in Real Time, and it handles auto-enrolment. So, no need to worry about pensions either.

K Consultants use Sage 50 Payroll in house, we have been end users for large organisations in the past, running payrolls for several hundred employee’s. We have implemented Sage 50 Payroll’s for numerous companies of all sizes for over 20 years, so we know how it works, we know the concerns that you have when preparing and running payroll’s.

So, let’s put some of those fears to rest.

Just some of the questions that we have been asked in the past.

- Auto- enrolment – we are so small, it is going to be a nightmare!

- Some of my staff have attachments of earnings, how does the system know how much to take?

- What if I forget to pay someone?

- What if I underpay/overpay someone can I make corrections?

- How do I get the payroll information to the Government?

- My employee hasn’t got a P45 can I still pay them?

- I want to group my employees by department.

- I like to see all my staff who are Fire Marshalls/First aiders easily.

- I need weekly and monthly payrolls; do I need 2 licenses?

More than ½ of businesses in the UK submit their payroll information directly to HMRC via Sage 50 Payroll, it is a safe, secure system. The data is sent\collected directly via the HMRC Secure Mailbox, which in turn can update the employees records directly, therefore no rekeying of data, no chance of making an error.

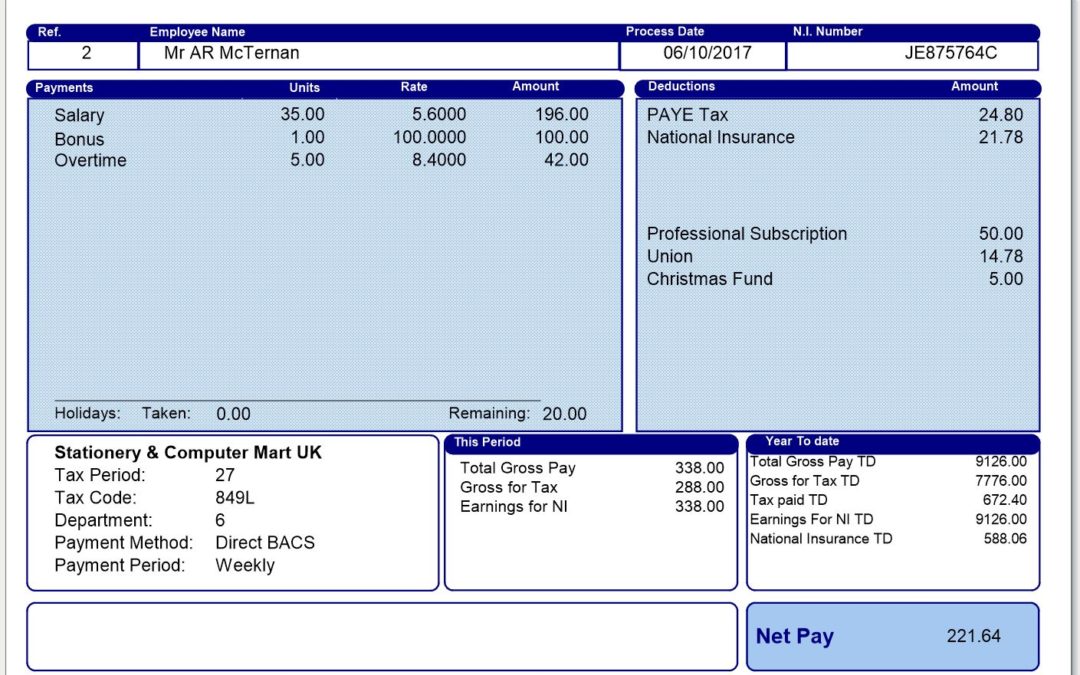

Save all your important employee correspondence and communications in one place, with secure access rights for users, and the function to limit users to being able to only access certain employee’s records, controlling what information a user can view. All is possible. Store information such as actual pay history, Tax codes, NI numbers, Statements of employment, telephone and address details, emergency contact details, all totally secure and password controlled.

Sage 50 Payroll has all the legislation, current and up to date, it manages all the statutory payments, SSP SMP, SPP, Adoption pay, Sage 50 Payroll processes student loans, attachments of earnings, salary sacrifices, child care vouchers, cycle to work scheme.

Sage 50 payroll will handle new starters, whether they have a previous P45 or not, the system can generate a P45 for your leavers, and via the submissions function it will automatically notify HMRC of the employee’s status.

Sage 50 Payroll is so flexible, employees can be grouped by departments and or cost centres, additional groups are available for reporting and analysis purposes, data can be export to excel and outlook,

Sage 50 Payroll has a calendar allowing you to diarise reminders, set dates etc, so no need to worry about missing or forgetting to do something.

Sage 50 Payroll ensures that your payroll runs smoothly, accurate and efficient, all payments and deduction are calculated automatically and of course once the payroll has been run it can produce the payment file to be directly importing into your bank software, again saving time, saving money, reducing the chance of rekeying errors.

No more needing to print payslips and take time distributing them, email your staff their payslips, all securely encoded.

Sage 50 Payroll can link directly to Sage 50c and Sage 200 posting the journal directly, saving time duplicating the journal and the possibility of errors.

What’s more it is cheaper than a bureau, keep it all in house, gives you control, give us call, let us help you.